haven't paid taxes in 10 years

5 Best Tax Relief Companies of 2022. You are only required to file a tax return if you meet specific requirements in a.

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Business Personal Taxes.

. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure to file timely. I havent filed taxes in over 10 years. Contact a tax professional.

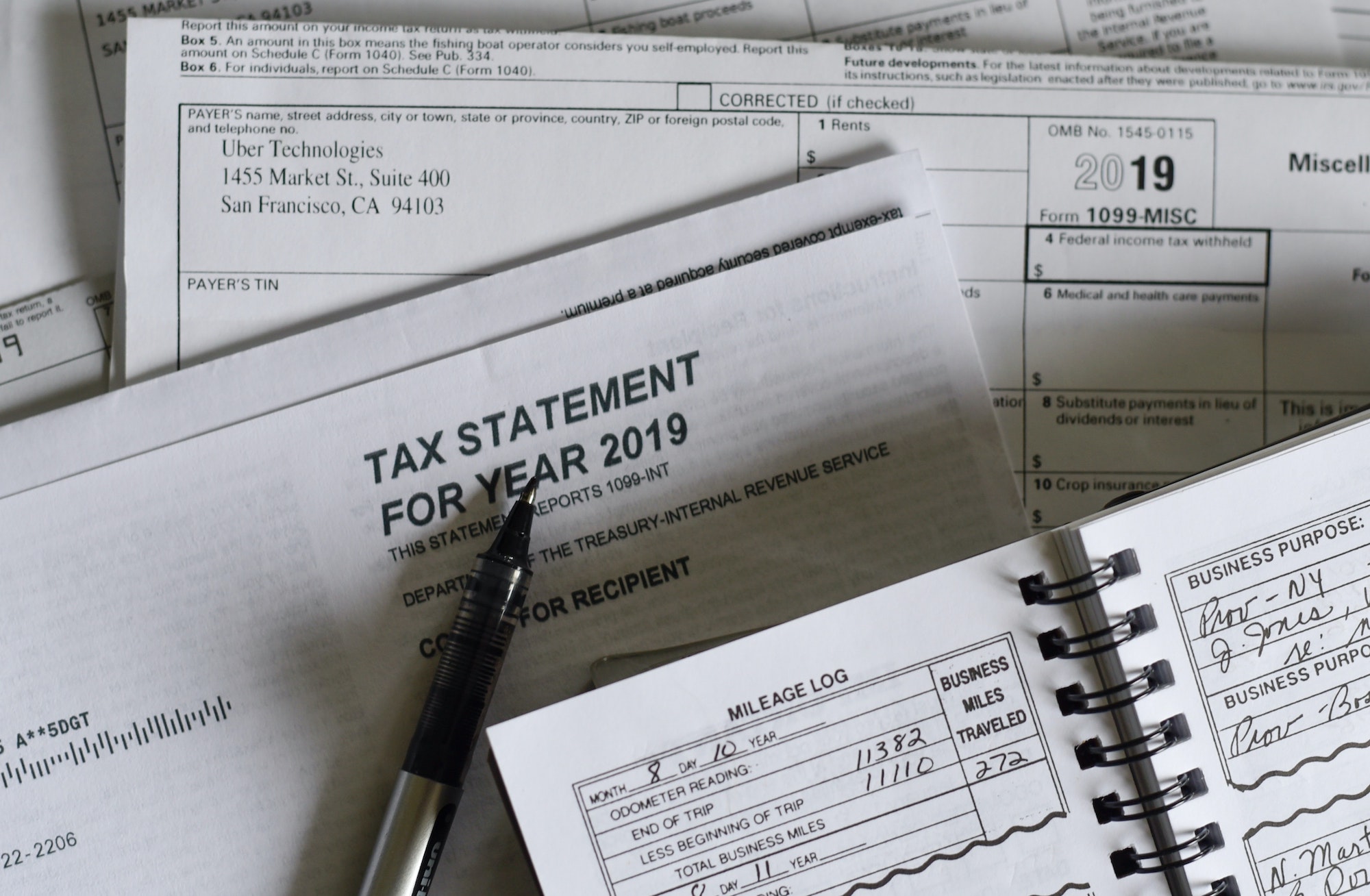

Havent Filed Taxes in 5 Years. Up until 2002 I was working on contracts as a W2 employee of various consulting firms. My income is modest and I will likely receive a small refund for 2019 when I file.

Overview of Basic IRS filing requirements. We can help Call Toll-Free. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

415 13 votes Failure to file or failure to pay tax could also be a crime. Failure to File Taxes. Approximately 70 million Americans will see a 87 increase in their Social Security benefits and Supplemental Security Income SSI payments in 2023.

Ad Take 60 Seconds To See If You Qualify For A Free Expert Tax Relief Consultation. Ad Need help with Back Taxes. Answer 1 of 31.

For more than 10 years the well-known chef author and television host failed to pay his taxes. You owe fees on the. Business Personal Taxes.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Ad Settle Tax Debts up to 90 Less. In 2002 a consulting firm I.

If you fail to file your taxes youll be assessed a failure to file penalty. However if you havent paid taxes in about 10 years and want to start now here are some tips to help you through. Dont wait for things to get worse because they will.

Before he became a near household name Anthony Bourdain had tax problems. Before April 15 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. The CRA will let you know if you owe any money in penalties.

To request past due return incomeinformation call the IRS at 866 681-4271. Dont face the IRS alone. Gift card will be mailed approximately two weeks after referred client.

Start with a free consultation. In 1997 I started working in IT. File back taxes with a tax expert with years of experience.

If you fail to file your tax returns on time you could be charged with a crime. The IRS recognizes several crimes related to evading the assessment. You will also be required to pay penalties for non-compliance.

Ad Created By Former Tax Firm Owners Based on Factors They Know are Important. The IRS contacting you can be stressful. If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation.

The following are some of the prior year forms and schedules you may need to file your past due returns. If your return wasnt filed by the due date including extensions of time to file. Its because even though you might not owe income tax you owe Social Security and Medicare taxes profit 9235.

Cant Pay Unpaid Taxes. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. The IRS recognizes several crimes related to evading the assessment and payment of taxes.

See the Top Rankings for Tax Help Companies That Fix IRS and State Tax Problems. We Help Taxpayers Get Relief From IRS Back Taxes. Referring client will receive a 20 gift card for each valid new client referred limit two.

Possibly Settle For Less. We work with you and the IRS to settle issues. Havent Filed Taxes in 10 Years.

You can either directly reach out to the IRS or. Honest Trusted Reliable Tax Services. Dont wait for things to get worse because they will.

End Your Tax Nightmare Now. Ad Highest Rated Tax Services. If youre overwhelmed with your taxes they might be able to support you with any tax issues as you file.

You will owe more than the taxes you didnt pay on time. If you are a freelancer you have to file with earnings over 400. Avoid penalties and interest by getting your taxes forgiven today.

After April 15 2022 you will lose the 2016. Theres that failure to file and failure to pay penalty. See if youre getting refunds.

I dont own a home I have no investments. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Ad Highest Rated Tax Services.

Tax Changes For 2022 Kiplinger

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Figuring The Capital Gains Tax Bite So The Irs Won T Zap You Los Angeles Times

Tax Tips What To Do If You Haven T Filed Your Taxes Defendernetwork Com

I Haven T Paid My Taxes In 10 Years R Gocommitdie

What Happens If I Haven T Filed Taxes In Over Ten Years

What Do I Do If I Have Not Paid Taxes For The Past 10 Years Quora

Rich People Are Getting Away With Not Paying Their Taxes The Atlantic

How To Pay Little To No Taxes For The Rest Of Your Life

What Happens If I Haven T Filed Taxes In Over Ten Years

Tax Penalties And Why You Should Pay On Time Taxcontroversy Com

/will-i-pay-tax-on-my-home-sale-2389003-v5-73871af4e690411c8fc3e03de02cb241.png)

Will I Pay Taxes When I Sell My Home

Can I Get A Stimulus Check Without Filing Taxes Saverlife

Why You Shouldn T Be Afraid Of The Irs Fox Business

When Are Taxes Due Tips For Last Minute Filers

Haven T Paid My Taxes For 12 Years

Unfiled Tax Returns Guidelines And Info On Filing Tax Returns Late

What Do I Do If I Have Not Paid Taxes For The Past 10 Years Quora